L&C's Rate Check service

Your mortgage safety net, so you know you'll always get the best deal possible.

What is Rate Check?

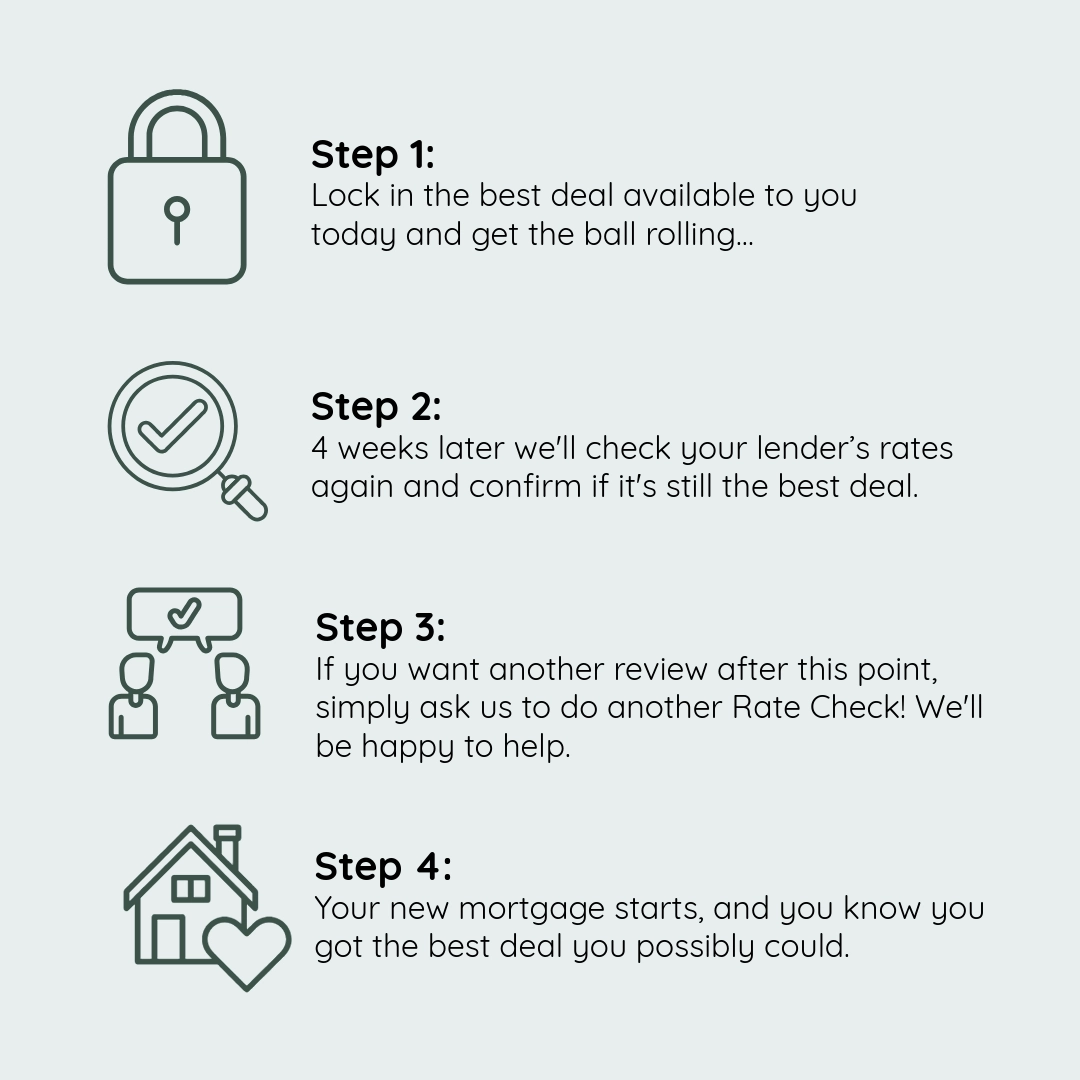

Mortgage rates change frequently, and your mortgage start date may be several months after you originally applied. Our Rate Check service means you can lock in the best mortgage deal available today and have a safety net.

How much could I save?

It could be quite a lot! Even a small reduction in your mortgage interest rate can save you £1,000s over your mortgage term.

In the first half of 2025 (1st Jan to 30th June), we checked over 13,000 customers’ deals and switched lots to new, lower interest rates! On average, our customers saved £1,197 on their new mortgage deal versus the deal they were originally offered*.

How much does it cost?

We don’t charge a fee for our entire advice service, including Rate Check.

Can I have more Rate Checks?

Absolutely, yes! We’ll automatically check for you 4 weeks after you initially applied, but you can ask us to check again at any time after that and we’d be happy to.

What's the catch?

No catch, we provide the Rate Check service completely fee free as part of our advice service.

It’s worth noting though that not everything that glitters is gold e.g. sometimes switching could incur additional fees from the lender, or you may be too close to your mortgage start date to switch. Your adviser will talk you through all your options and will recommend what’s best for you – we’ve got your back!

You might also be interested in.

https://www.landc.co.uk/remortgage/remortgage-products/when-to-remortgage

https://www.landc.co.uk/mortgage-guides/when-to-remortgage

*13,266 L&C customers requested a Rate Check between 1st Jan and 30th June 2025 and saved a combined £15.88m. On average customers saved £1,197.04 over the term of their mortgage deal. Individual savings will depend on rates, deals and the amount of the mortgage.

Why wait?

Get started today, tell us a bit about your circumstances and book an appointment to get advice on the best mortgage deal for you.